To calculate XIRR, an additional input is needed and that is the dates of each cash flow. XIRR uses the exact number of days between two cash flows. The key difference between the two is that IRR assumes regular intervals between periodic cash flows. In private commercial real estate transactions, the return is calculated using a modified version of the IRR function known as XIRR. If this value is used as the discount rate in the NPV calculation, the result should be $0 or close to $0.

Microsoft excel formulas series#

The result of the calculation is 16.01%, which represents that annual rate of return on this series of cash flows.

Microsoft excel formulas pro#

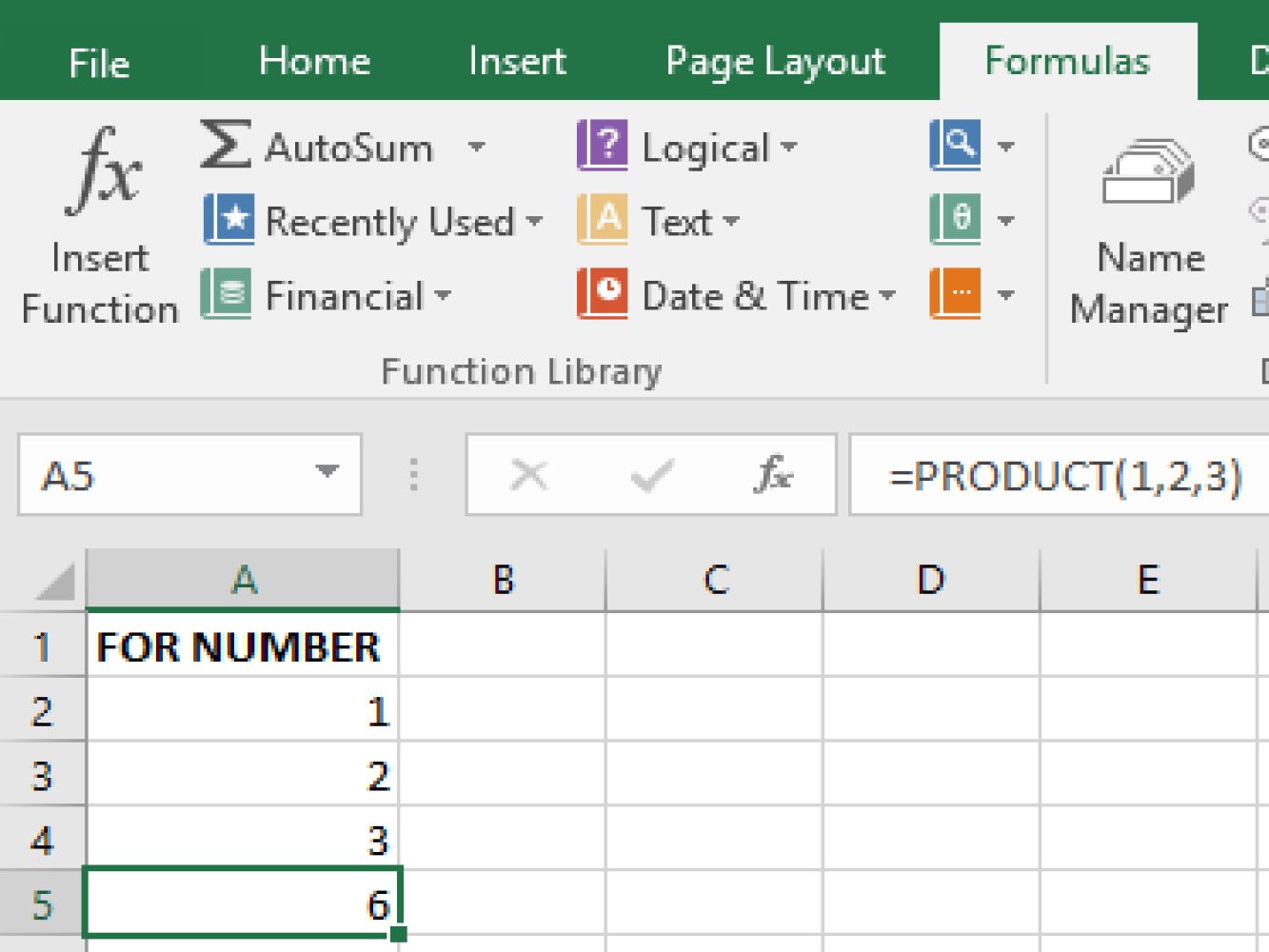

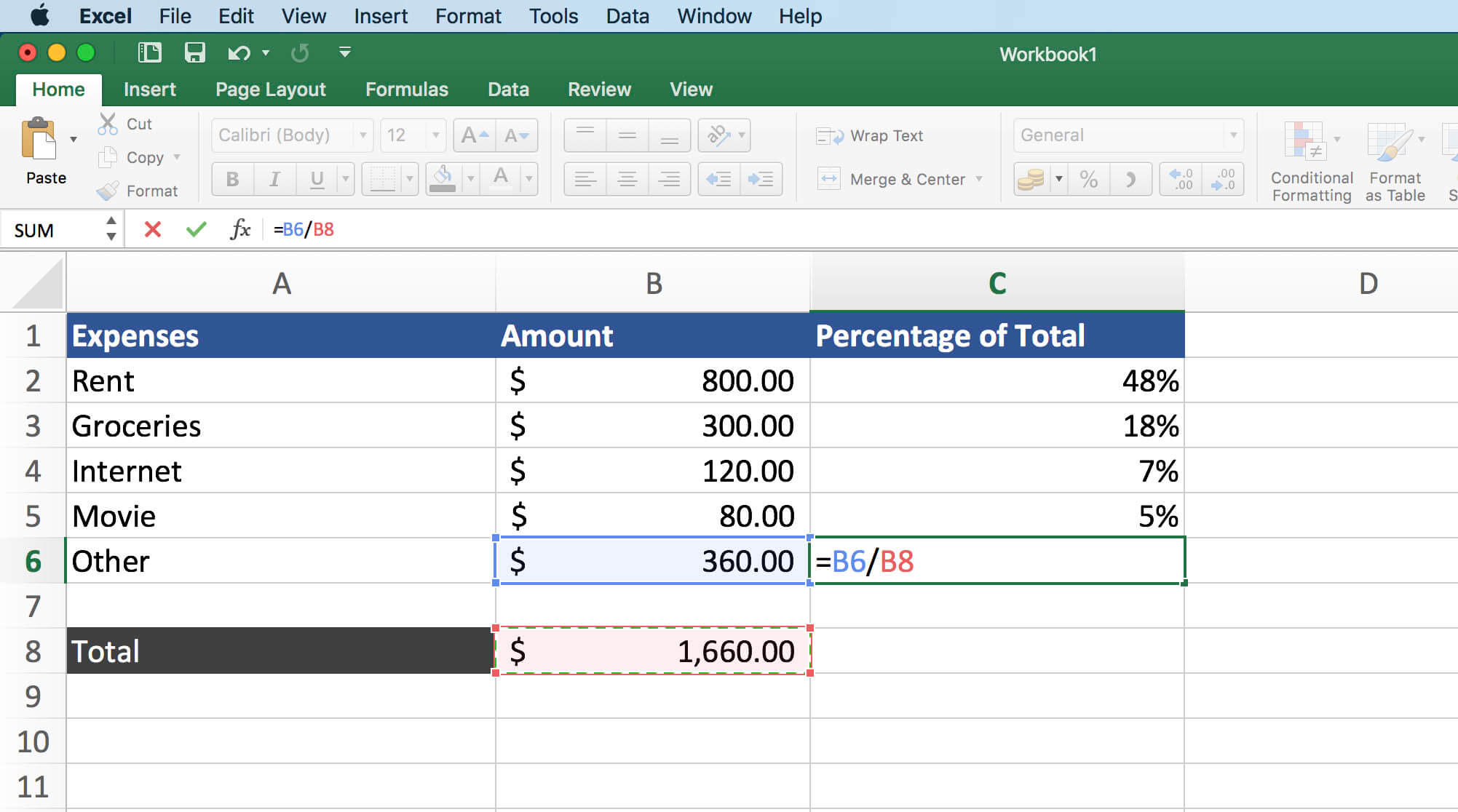

Replacing the variables in the IRR function with the actual cash flows from the pro forma looks like this: In other words, when the discount rate used in the NPV function is the same as the IRR, the result is $0. The Internal Rate of Return is the discount rate that sets the NPV of future cash flows equal to zero. Excel Formula #2: IRR/XIRR – Internal Rate of Return What does this mean? It means that there is a big difference between the discount rate of 7% and the internal rate of return (IRR), which is the next function that real estate investors should be familiar with. The result of this calculation is $319,590. Using the sample pro forma above, the NPV of the cash flows (assuming a 7% discount rate) can be calculated by replacing the variables in the above function with the actual cash flows as follows: The “ NPV” function calculates the net present value of a series of cash flows by using a discount rate and a series of future cash flows. Excel Formula #1: NPV – Net Present Value To create the pro forma and analyze a property’s projected cash flows, there are five Excel functions that all investors should be aware of. When complete, the pro forma may look something like this: This value is subtracted from NOI to determine the cash available for distribution (sometimes called pre-tax cash flow), which is another key investment analysis metric. Next, a property’s debt service is calculated using the loan amount, interest rate, and amortization period. This is a critical input to a property’s valuation calculation. Gross income less operating expenses equals a key real estate metric known as Net Operating Income (NOI). Separately, ancillary fees are obtained from a property’s historical operating statements.Įxpenses are obtained from a combination of the property’s historical financial statements and the actual invoices for things like property taxes, insurance, maintenance, and property management. These documents provide key information about things like the lease start date, end date, rent amount, and rental escalations, if any. Rents are obtained from reviewing the property’s rent roll and/or individual leases. Pro forma income is derived from tenant rents and ancillary fees. But First, It Starts With the Pro FormaĮvery financial model starts with a pro forma, which is an estimate of the property’s income, expenses, and debt service for the entirety of the planned investment holding period. In this article, we explain five Excel formulas for real estate analysis, including net present value, internal rate of return, payment, date difference, and sum and average. As it relates to private real estate analysis, there are five formulas that all investors and analysts should know to fully understand an investment’s risk/return profile. For this reason, it is common to use a spreadsheet tool, such as Microsoft Excel, to assist with real estate analysis.Įxcel is a powerful program that can perform a near-infinite number of calculations, but there can be a learning curve for those unfamiliar with the nomenclature and actions needed to get the most out of the tool. There are numerous variables to consider, and an abundance of complex math to perform. While the concept is relatively simple, the real estate analysis itself can be much more complicated in practice.

Fundamentally, private commercial real estate analysis seeks to compare the cost of an asset to the cash flow that it produces.

0 kommentar(er)

0 kommentar(er)